Top Features of Financial Check API

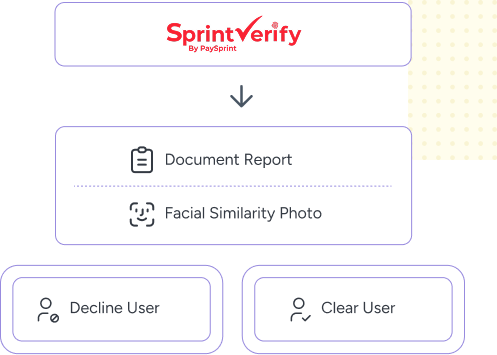

The Power of Fraud Detection

Safeguard your business against financial threats with our powerful fraud detection tool. Our Financial checks include features designed to identify suspicious activity patterns hinting at fraudulent behaviour.

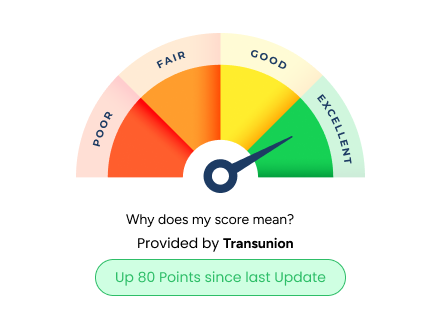

Crack Credit Risk

We provide the best financial check API in India. We encourage businesses to evaluate the creditworthiness and financial stability of their businesses and individuals by analysing credit history, debt levels, and payment and behaviour to gauge the risk of default or non-payment.

Compliance Check

SprintVerify's Financial Checks help companies make sure they're adhering to industry norms and legal regulations. Businesses can lower their risk of non-compliance and steer clear of possible legal or reputational setbacks by using our API to validate the integrity and correctness of financial data.

Why Choose Us?

-

Enhanced Security

The API from SprintVerify protects your financial transactions from fraud and illegal access by adding a layer of security with advanced encryption and authentication.

-

Compliance

The Financial Checks API from SprintVerify makes it simple to comply with regulatory requirements. You can lower your risk of charges and keep up with changing rules with integrated compliance checks and reporting solutions.

-

Effortless Integration

Integrate our Fraud Indicators API seamlessly with the systems you already have. A smooth setup and user-friendly UI make fraud prevention quick and easy.

Use Cases for Financial Checks API

SprintVerify’s innovative solution streamlines financial checks and effectively mitigates risks in a wide range of industries, including banking, fintech, insurance, e-commerce, real estate, and healthcare.

Banking

Banking HRMS

HRMS Logistics

Logistics Healthcare

Healthcare Insurance

Insurance Lending

Lending

APIs under Financial Check

Frequently Ask Question

Explore our FAQs to uncover the what, why, and how behind our verification solutions—and see how we're helping businesses onboard faster, stay compliant, and build trust in the digital world.

You have different questions?

Our team will answer all your quesions.

We ensure a quick response.